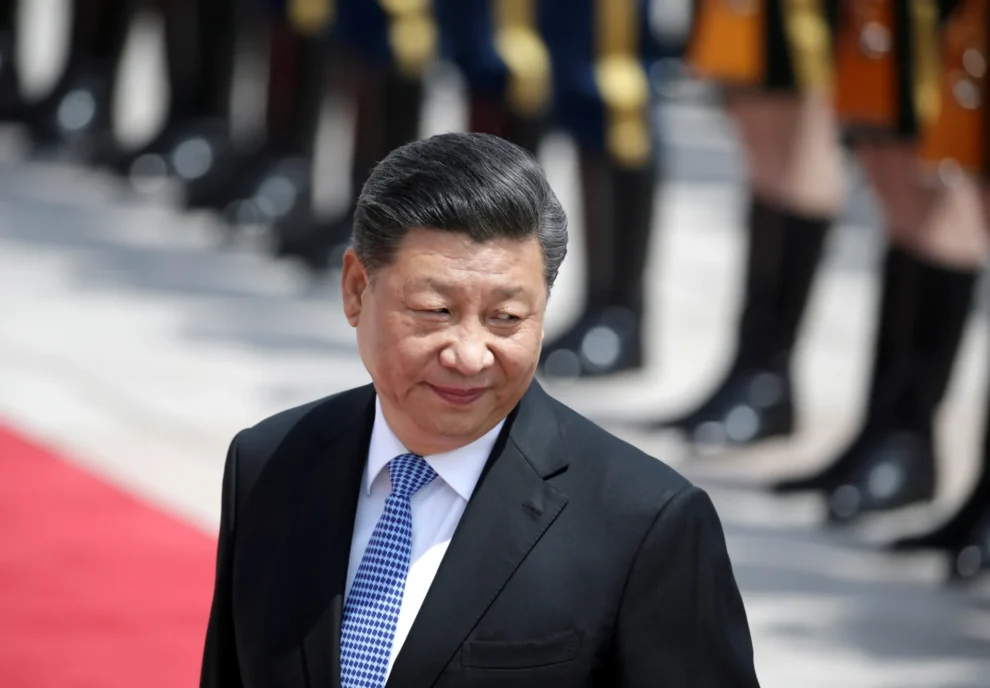

The alarm bells are ringing in Latin America. Chinese president Xi Jinping’s recent visit to Latin America caps off a decade of remarkable advances for China in the United States’ shared neighborhood. Both Xi and President Biden attended the Asia-Pacific Economic Cooperation (APEC) forum in Lima, Peru. Both then traveled to Brazil for the G20 Summit meeting. The public imagery of the two meetings said a lot about China’s advance in Latin America with little to no U.S. pushback.

Organizers say the APEC group photo placed leaders in alphabetical order, with Xi Jinping next to leaders from Canada and Chile, but it might as well have been a metaphor for waning U.S. influence and lack of strategy in Latin America. Biden was placed in the back row, far from Peruvian president Dina Boluarte. Meanwhile, Xi beamed in the front row next to his Peruvian host. Beyond Xi’s participation in APEC meetings, he also inaugurated a $3.5 billion deepwater megaport in Chancay, just north of Lima. This Belt and Road Initiative (BRI) project will increase connectivity between Beijing and South America, trimming shipping times for agricultural and mineral commodities by about 10 days and avoiding stops in either Mexico or Los Angeles. Offering a direct shipping lane from South America to mainland China, Chancay will serve as the fulcrum of a burgeoning maritime-land corridor between China and Latin America. China says this will benefit not just Peru but also surrounding countries, with planned infrastructure projects allowing Brazil, Chile, Ecuador, and Colombia to leverage the port, too. Previous CSIS research utilizing satellite imagery has also highlighted Chancay’s potential for dual use. The berths at the port are wide enough for the People’s Liberation Army to dock naval vessels, something that has raised the concerns of the U.S. Southern Command.

To sum up the bad news of the past decade—the opening of Chancay is the culmination of more than a decade of ceding influence to China in Latin America. Trade between Beijing and the region grew tenfold over the past two decades, and China has emerged as the second-largest trade partner for the region after the United States. When factoring out Mexico, China easily takes the number one spot. Since 2018, 22 of 26 eligible countries have joined China’s signature BRI, and the holdouts, large countries like Brazil and major U.S. trade partners like Colombia, are openly contemplating BRI accession. The region has formed a core part of China’s Global South strategy, remaining “non-aligned” while pursuing the reform of international organizations and spearheading alternative visions of global order with institutions such as the BRICS.

To sum up the good news of the moment—the secretary of state nominee, Senator Marco Rubio, has spent much of his time in the Senate thinking about Latin America, and the incoming national security adviser, Representative Michael Waltz, understands the region and speaks frequently about its dynamics. In a world with active conflicts in multiple other theaters, the Trump administration is still poised to pay lots of attention to Latin America. Its legacy in the region could—and should—be placing the United States on a more competitive path with China in Latin America through the development of a U.S. strategy for China in the region.

Rapid and Dramatic Advance

China has advanced rapidly in just about every corner of the region, including in highly strategic ways that go beyond mere increases in bilateral trade. Here are a few salient points:

- China has the largest amount of space infrastructure outside of mainland China in Latin America and the Caribbean. Of particular concern is Espacio Lejano, the deep space station that effectively operates like a sovereign slice of Chinese territory in the Argentine Patagonia. Yet, China operates or has access to around a dozen other facilities throughout the hemisphere.

- Chinese state-owned enterprises dot the region, with electric vehicles being a particular focus of recent activity. Electric vehicle giant BYD has announced interest in opening factories in several countries, including Mexico. China’s large construction giants are very active in the region, as are its mining operations. A handful of countries maintain trade agreements with China, and several more have commenced negotiations on trade agreements with China.

- China maintains contracts to upgrade or operate more than three dozen ports in the region, including potential dual-use deepwater ports. There are both military and commercial implications. China may seek to leverage its port infrastructure in a conflagration over Taiwan. Short of war, however, China gains significant commercial surveillance capabilities by owning and operating ports in Latin America—surveillance that can undercut U.S. business in the region and crossover to have military application. The ability to renovate, upgrade, and operate ports provides China with a concerning level of control over customs and security, giving rise to concerns about organized crime activity, such as the import of chemical precursors for synthesizing fentanyl through Chinese-operated port terminals in Mexico. According to information from Mexico’s Secretariat of Defense, 273 million dosesof fentanyl were seized between 2015 and 2023 and were trafficked through the Mexican ports of Lázaro Cárdenas, Manzanillo, and Ensenada. The same concern about attracting organized crime groups applies to the Chancay port in Peru.

- China was an early investor in Latin America’s critical minerals space. Through long-term offtake agreements, it has rewired much of the region’s mineral trade toward China, where it is refined and then exported—often back to Latin America—at a markup. Chinese mining companies have won concessions in all the region’s important mining powers. Control over extraction, and especially refining, gives China a key chokehold on the minerals supply chain.

- Although the United States remains the preferred defense partner, China has increased exchanges with Latin American armed forces. Recently, Brazil and China held joint military exercises, simulating an amphibious invasion. The operation carried the unfortunate name “Operation Formosa.” The People’s Republic of China (PRC) has imitated the United States in offering international military education and training to regional armed forces, providing an opportunity to grow influence networks and exchange on topics like training and doctrine. China has also sensed an opening to compete with the United States by increasing police cooperation on civilian security matters. Representing just 8 percent of the global population but about one-third of global homicides, Latin America remains uniquely vulnerable to China’s offer of cooperation on citizen security.

Latin America remains the most important region of the world for Taiwan and its formal diplomatic allies. Yet, Taiwan has lost five of its formal diplomatic allies in the last seven years—Panama, El Salvador, the Dominican Republic, Nicaragua, and Honduras. Flipping the remaining seven diplomatic allies in the Western Hemisphere remains a top PRC goal in the region.

- China has lent its support to some of Latin America’s most brutal authoritarian regimes. Venezuela, Nicaragua, Cuba, and Bolivia all count China as major economic and security partners. As previous research from CSIS demonstrates, China’s expansion in the region has coincided with massive declines in the quality of governance and democracy. The research shows that this may be far more than a coincidence, with China’s engagement contributing to democratic backsliding in Latin America.

- While Antarctica remains a zone of peace governed by the Antarctic Treaty until 2048, recent Chinese actions have given Antarctic powers pause. In 2014, Xi Jinping declared China’s intention to become a “polar power.” Since then, China appears focused on building a larger presence on the continent, possibly leveraging research activity as cover to map mineral and energy deposits.

Beyond these specific projects, of note is China’s advance in U.S. partner countries, as well as those that set out to decrease the role of China in their economies and shun Chinese investment where possible. Mexico comes immediately to mind in the category of partner countries. The United States’ largest trading partner has seen growing Chinese influence lately. Last year, Chinese companies announced nearly $13 billion in new investments, and there are well-founded concerns about the undercounting of Chinese investment. The Rhodium Group estimates that Chinese investment in Mexico may be six times higher than the level shown in official government statistics, lending credence to U.S. and Canadian concerns regarding a Chinese “backdoor” via the U.S.-Mexico-Canada Agreement to circumvent tariffs on imports.

Colombia is another country in the former category of partner countries. Often referred to as the linchpin and the United States’ greatest strategic ally in the region, the election of leftist president Gustavo Petro has been a game changer for China-Colombia relations. Beyond an uptick in trade flows—China will soon overtake the United States as Colombia’s largest trade partner—Colombia under Petro has expressed an interest in acceding to the BRI and joining the BRICS Bank. The country seeks up to $40 billion in climate financing and has said it will go to China if the United States is unwilling to partner. Key infrastructure projects, such as the Bogota metro, will be built by Chinese state-owned enterprises.

In Argentina, President Milei came to power criticizing China and vowing to reduce the country’s influence. Furthermore, the libertarian president has sought a close working relationship with President Trump. However, he now calls the PRC an “interesting trade partner” and held a bilateral meeting with Xi at the recent G20 Summit. The PRC maintains a direct credit line between the Chinese central bank and Argentina’s central bank, furnishing it with considerable influence over Argentina’s ability to pay back the International Monetary Fund.

In other countries, unforced errors have contributed to diminished U.S. influence. In Guyana, the world’s newest petro state, the Biden administration blocked $180 million in infrastructure financing through the Inter-American Development Bank. Guyana’s remarkable economic growth—last year, it was the world’s fastest-growing economy—has been catalyzed by major offshore oil discoveries, the reason the Biden administration blocked the loan. China has since filled the void, which is all the more frustrating given Exxon Mobil made the original oil discovery, and the consortium that will soon be pumping nearly one million barrels of oil per day includes Hess Corporation, another U.S. company. These wounds are of the self-inflicted variety.

While Brazil declined to join the BRI at the recent G20 Summit, the country “recognized the relevance” of the initiative and is likely to join in the future. Still, China and Brazil signed nearly 40 agreements at the G20, hailing a “new phase” in their bilateral relationship. Beyond trade, the two countries are accelerating cooperation in sensitive areas such as space exploration, with Chinese commercial space companies set to launch satellites from Brazil’s Alcantara Space Station.

In Need of a Strategy

Simply put, the United States can no longer afford to engage in strategic neglect of its own shared neighborhood. For too long, China has been able to advance its geopolitical aims in a near strategic vacuum. For too long, the Chinese offer has been the best offer for partners and allies—too often because it has been the only offer.

Any realistic strategy must start by recognizing several things. First, China is here to stay in Latin America. An effective U.S. strategy cannot have as its goal extricating China from the region. Second, an effective U.S. strategy must preserve core U.S. interests in Latin America and play to both the regions and the United States’ strengths. The region must remain a hub of vibrant democracies driven by market economies. Political and economic models that are explicitly anti-Western should find no safe haven in the Western Hemisphere.

With these principles in mind, in previous work, CSIS has outlined a grand strategy for addressing China in Latin America that can be summarized: insulate, curtail, and compete.

Insulate: China is a coercive actor. The PRC often seeks to coopt political leaders, utilize the weight of the Chinese economy, and/or punish those it sees as overly critical or disloyal. These strategies can be especially baleful in unconsolidated and developing democracies. In this context, the United States must identify vulnerabilities in Latin American democracies that the Chinese Communist Party is likely to exploit, and it must insulate those vulnerable points to keep China from making large strategic gains. Such examples include opportunities for corruption and cooptation in procurement and the tender process for large infrastructure projects. China’s authoritarian nature has not prevented it from developing a nuanced understanding of the dynamics present in Latin America’s democracies. Forcing China to settle for strategies that would, at best, see the PRC make incremental gains in Latin America would be a massive improvement over current policy, affording the United States more space and time to compete effectively.

Curtail: The biggest cliché about China’s presence in Latin America is that “countries do not want to choose between partners.” While the United States should not be in the habit of dictating Latin America’s trade partners, there are select areas where both the U.S. and the regional strategic interest should be overriding. The strategic community has not found consensus on exactly which areas, but one is slowly coming into focus: semiconductors, telecommunications, artificial intelligence, green technology, critical minerals, and cloud computing, among others. In short, sectors where dominance in the industry will help to write the future rules of global economic governance.

In these select areas, the United States should demand Latin American countries make strategic choices—and lay out those choices clearly. Seeking to curtail Chinese activity in the region could easily backfire, so keeping this area circumscribed and marrying it with competition is key.

Competition: The United States has more free trade architecture in Latin America than any other region of the world. It has an array of development agencies at its disposal to galvanize investment and private sector interest, such as the U.S. Development Finance Corporation. And it possesses the largest number of voting shares in multilateral financial institutions, such as the World Bank, International Monetary Fund, and Inter-American Development Bank, that can catalyze investment. When the United States seeks to curtail Chinese investment and activity in key industries, it must compete to put a viable, cost-competitive alternative on the table. If it does not, countries in the region will interpret our presence as filled with moral lessons but little else. In some cases, that alternative might be American, but it just as often might not be. The United States should work to bring more Japanese, Korean, Taiwanese, and European investment to the region, especially in sectors where the United States is less likely to invest or where partner countries can bring their comparative advantages.

The next administration will face daunting international tasks. Resolving conflicts in multiple theaters will require considerable energy and political will. Yet, China’s advance in the United States’ shared neighborhood should be of critical concern. The bad news is how dramatically China has grown its presence in recent years; the good news is that it is not too late to push back and regain the U.S. foothold. The Trump administration should leave a legacy of placing the United States on a more competitive footing with China in Latin America.